Adaptive Support

How to create or link a portfolio

Once you're logged in, create broker account links to see personalized analysis—no purchase is necessary to play with the downside calculators, backtests & portfolio analytics.

Important: Account links are also a safe & easy way for Adaptive to automatically receive updated holdings. The account link is read-only, with no ability to move money or make trades. Also no client name or client account number is brought over—you can name the Adaptive view however you want, with or without identifying client information.

Note: You can also email us a spreadsheet at support@adaptive-investments.com & we can help you upload or manually enter if you would prefer not to set up the direct link.

Detailed guides on how to create or link a portfolio:

- Plaid Integration – Plaid Portfolio Import Guide.pdf

- CSV Import – CSV Portfolio Import Guide.pdf

- Manual Entry – Manual Portfolio Entry Guide.pdf

How to set up an account with Adaptive

Request a Pilot Account

A Pilot Account gives you access to Adaptive One-Click Downside Protection products and risk analytic tools. With a Pilot Account, you can:- Link your portfolio through secure Plaid integration, CSV upload, or enter manually

- Compare Protection Price Quotes for selected protection periods & levels

- Buy portfolio protection from Adaptive, or use Adaptive’s Do-it-Yourself Put Options Shopping List suggestions to shop for put options in public markets

- Identify the Risk Contribution of individual holdings in a portfolio for better risk management

- Quantify downside protection benefits with Backtests & Monte Carlo simulations

Step 1: Choose Pilot Account Type

- Investor: Mass affluent retail investors & gear heads managing their own investment portfolios

- Advisor: Registered Investment Advisors & Family offices who manage clients portfolios for small and high net worth individuals

Step 2: Provide email address to be whitelisted

Important: When you create your Adaptive login, you will be prompted to choose between an "Investor" account and a "Advisor" account— Your whitelisted email will have permission to create a Username for both account types. Note that you will have to create two separate Username to login — Investor login & Advisor login are two completely different user accounts, even though they share the same whitelisted email address.Step 3: Create a Username and Sign-up

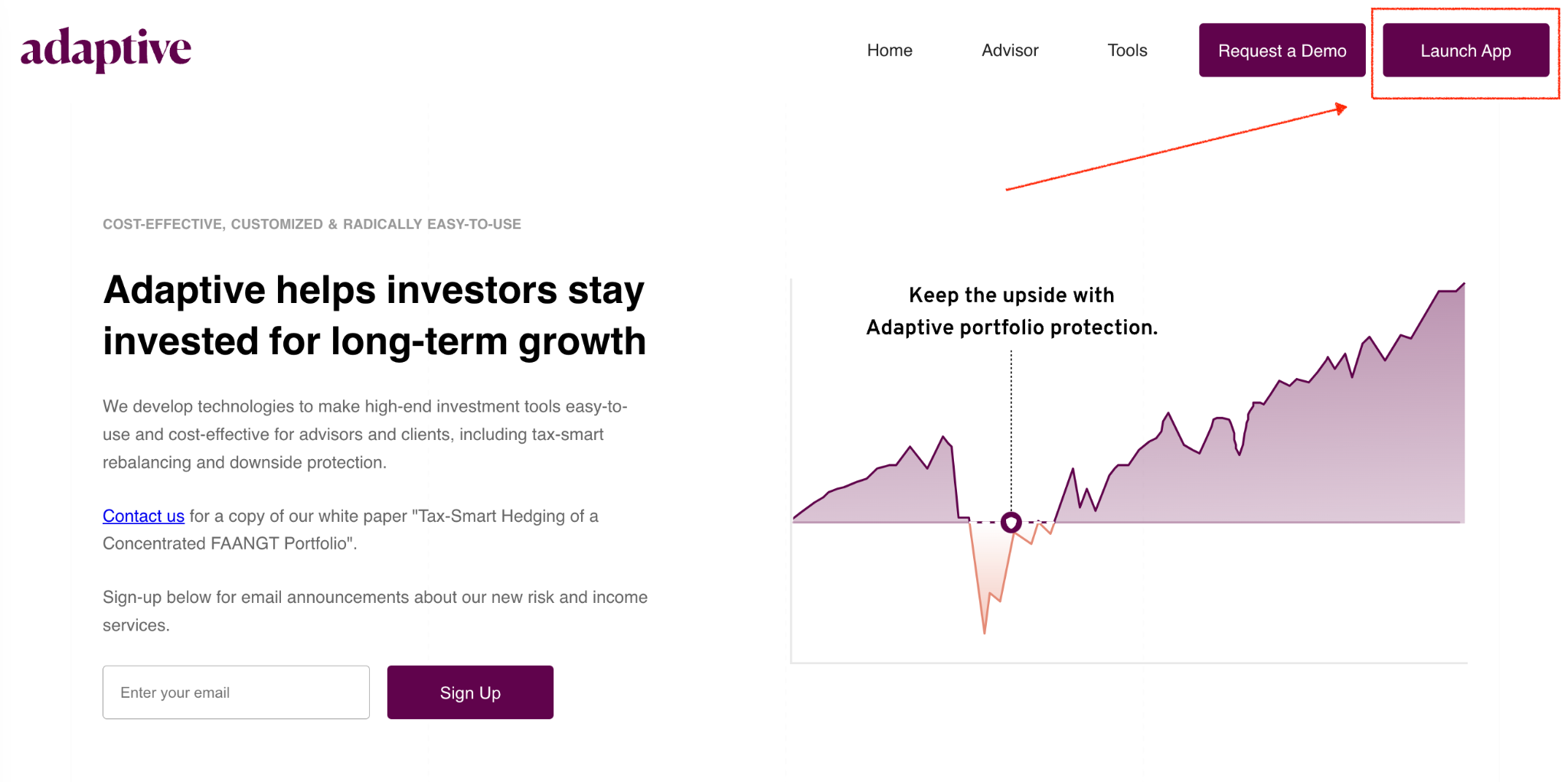

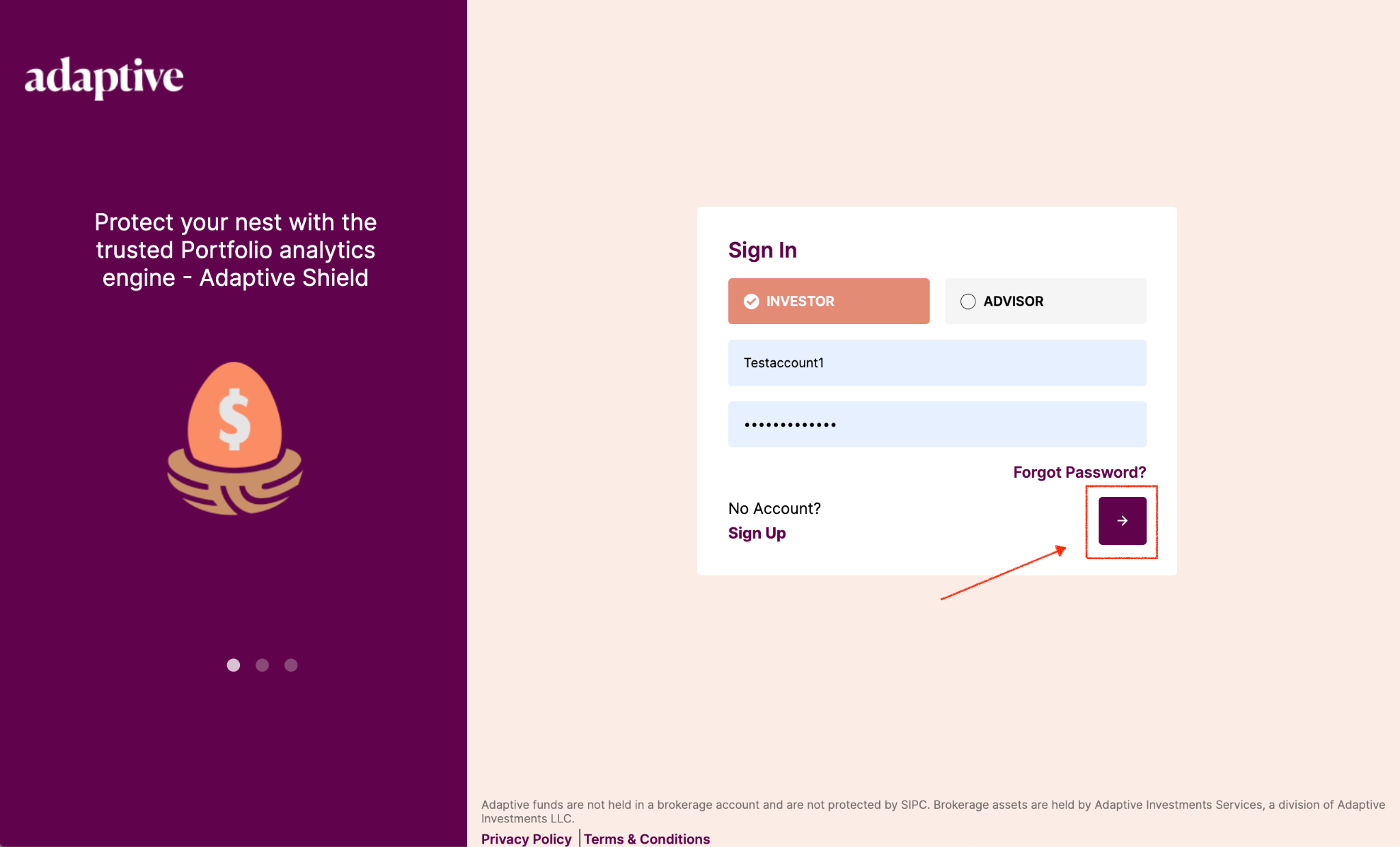

You can now create your Adaptive Username by following the steps below:1. Go to https://adaptive-investments.com/ and click on the “Launch App” button in the top right corner of the web page or go directly to the web-app login at https://app.adaptive-investments.com/

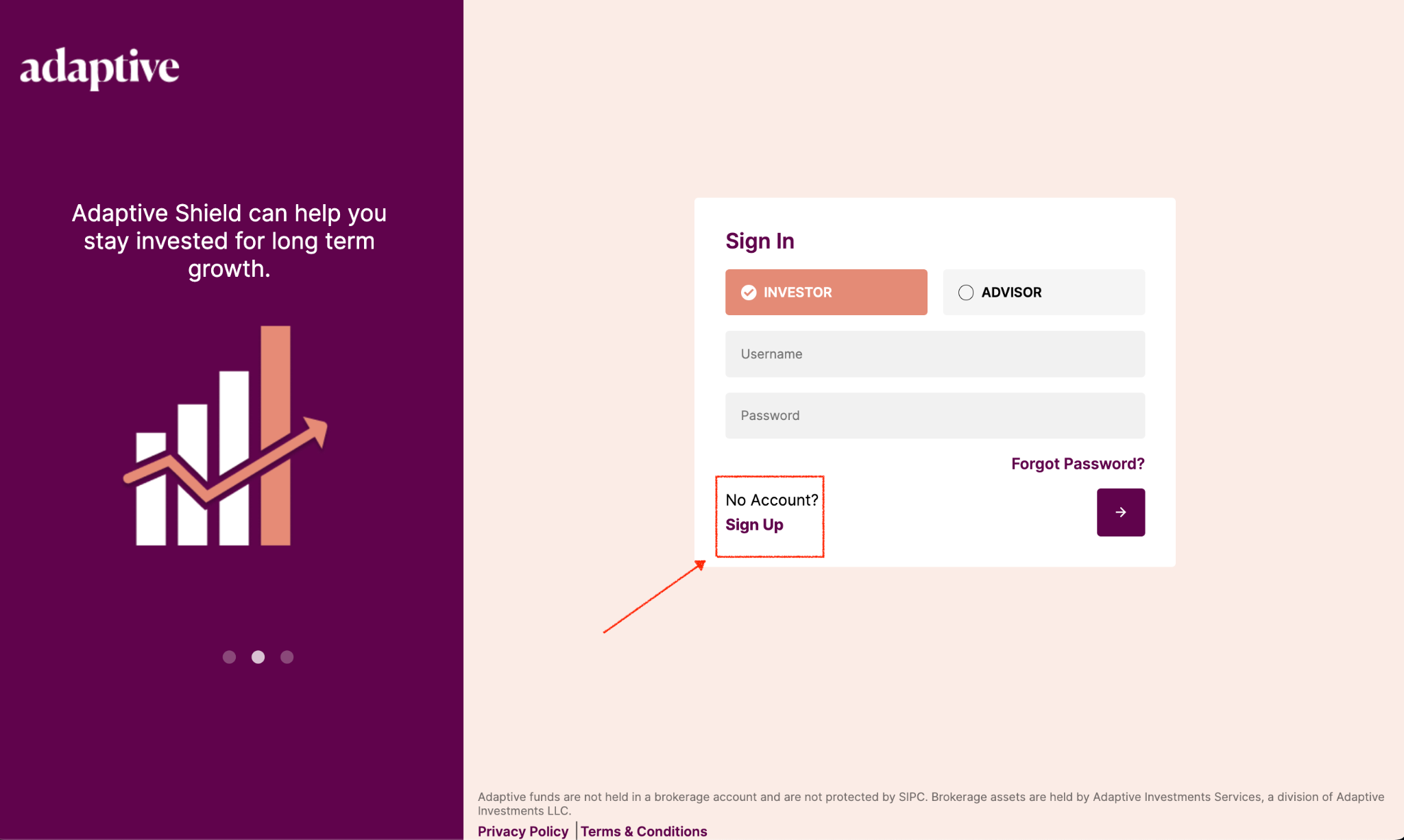

2. Click Sign Up

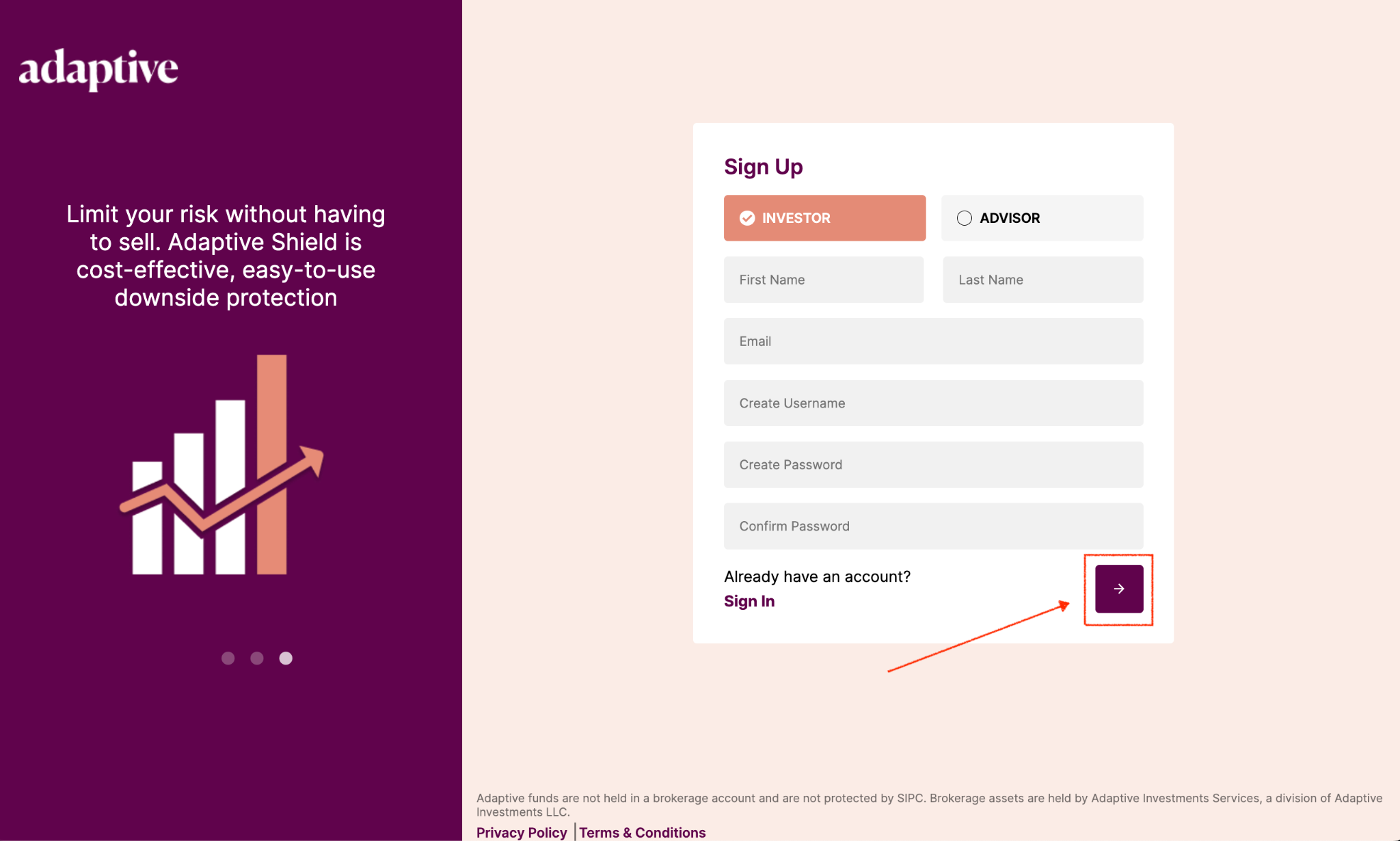

3. Enter your First Name, Last Name, Whitelisted Email, create a Username, Create and confirm Password Note: Advisor Sign Up will have an additional field to enter Company Name.

4. Click next “purple box arrow” in the bottom right corner

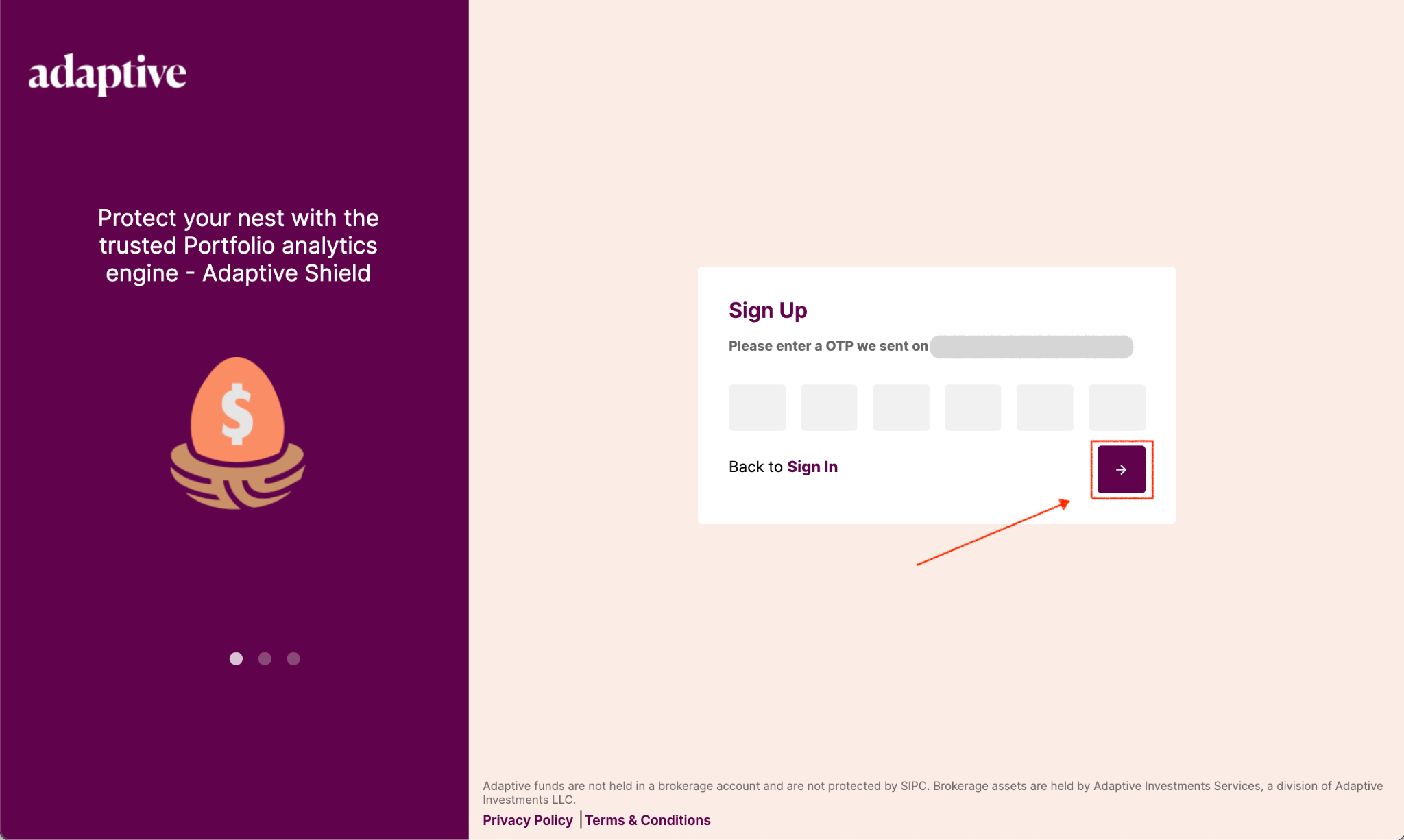

5. Enter “OTP” verification code Tip: Check for an incoming email from no-reply@verificationemail.com in your inbox/spam folder.

6. Click next “purple box arrow” in the bottom right corner

7. Click Sign in “purple box arrow” in the bottom right corner Note: Once you complete #6, you will be redirected to the login page with your new username & password.

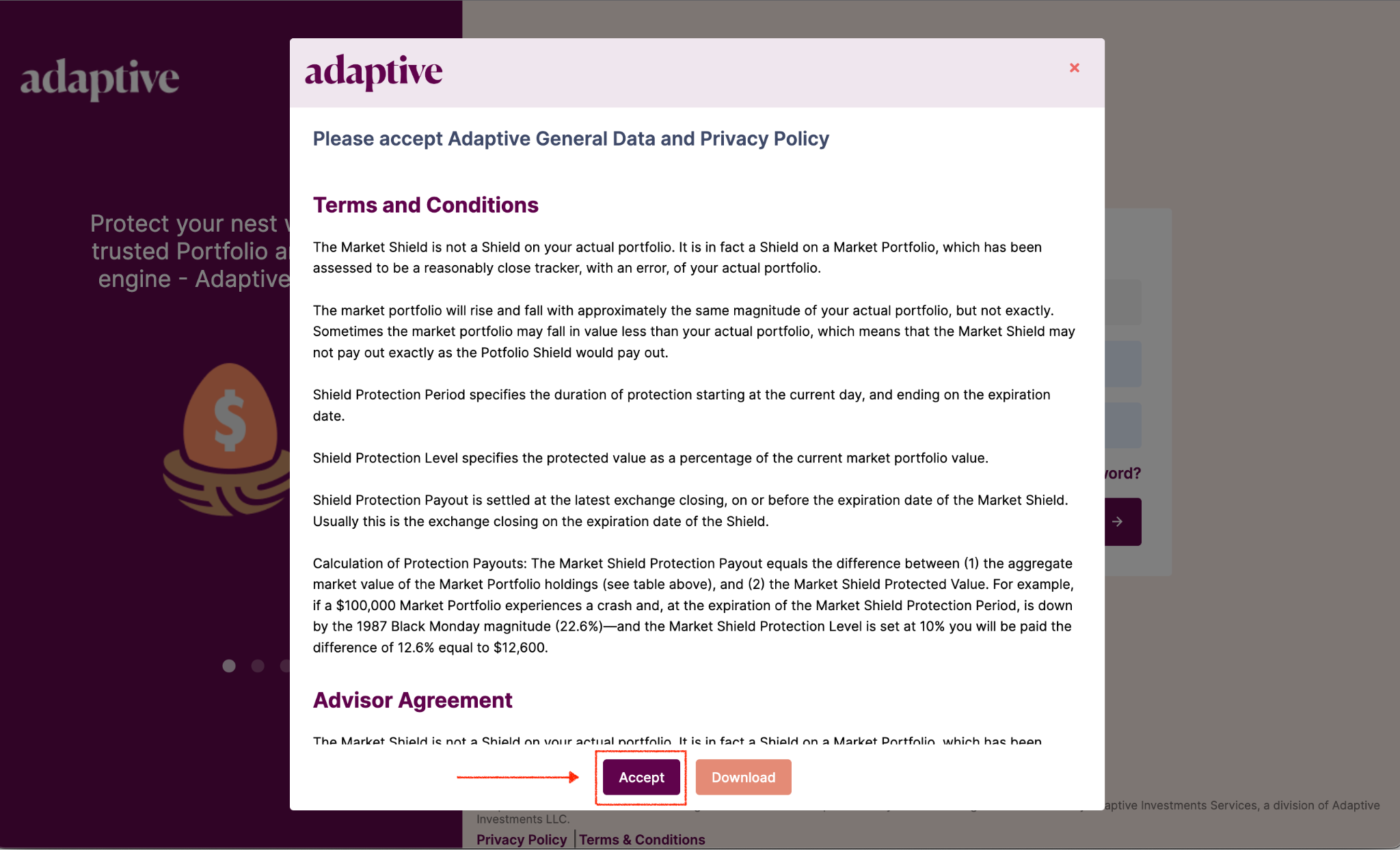

8. Accept Adaptive Terms & Conditions

What is Adaptive Investment Solutions

Adaptive offers One-Click Downside Protection to help advisors & investors manage portfolio risk with personalized hedging. Adaptive fintech develops technologies to make high-end investment tools easy-to-use, cost-effective & personalized for advisors and clients portfolios to limit losses & dial-down portfolio risk.

Adaptive Wallet

Will Adaptive retain any information about my account?

Adaptive does not retain any account information, all sensitive information is passed to our Treasury service, Modern Treasury, and discarded. Adaptive only keeps the nickname for internal use.

How do I check the balance of my client wallet account?

The balance of your client wallet account is shown in the top-right corner of most screens when you are logged in to Adaptive, under the heading “Wallet Balance”. See also:

- “How do I deposit funds into my Adaptive client wallet account, and also make withdrawals?”

- “How do I receive Shield payouts?”

How do I receive Shield payouts?

Payouts due under Shield guarantee agreements are deposited to the client wallet account. Payouts will appear in your client wallet the next business day following the settlement date of the guarantee agreement. You can use the funds to buy another Shield or withdraw them to a verified external account through wire transfer or ACH. (See also “How do I deposit funds into my Adaptive client wallet account, and also make withdrawals?”)

How do I deposit funds into my Adaptive client wallet account, and also make withdrawals?

Have you already created a client wallet account? If not, see:

You will be able to transfer funds to and from your Adaptive client wallet account with your verified external account.

Important: All customer wallet accounts are held safely and securely at Chase bank in a segregated customer money account.

Go to your user profile and select the "Deposit/Withdraw funds" screen. Use the routing number and virtual account number for your wallet to transfer funds through wire transfer or ACH.

Note: Transfer of funds typically takes 24 hours to complete.

Once you have funds in the wallet, you can buy a Shield up to the amount you have available.

- “How do I create an Adaptive client wallet account for Shield purchases and payouts?”

How do I create an Adaptive client wallet account for Shield purchases and payouts?

Set up the account by following these steps:

- Add Payment Instruction– go to the “Payment Instructions” screen from your client profile and click "Add new account." Provide the account name, number, routing number, and a nickname. Once a payment instruction has been created, a unique virtual account will be assigned to you.;

- Verify an External Account for Fund Transfers Having completed Step 1—including the creation of a unique virtual account number by Adaptive—you will be asked to verify your external account information. Adaptive uses a micro deposit method for verification. Two small deposits from Adaptive will be sent to the client's account, usually within one or two business days, and then withdrawn. Enter the deposit amounts in any order on the “Payment Instructions” screen within five days to verify the external account.;

- Deposit Funds – see “How do I deposit funds into my client wallet account?”;