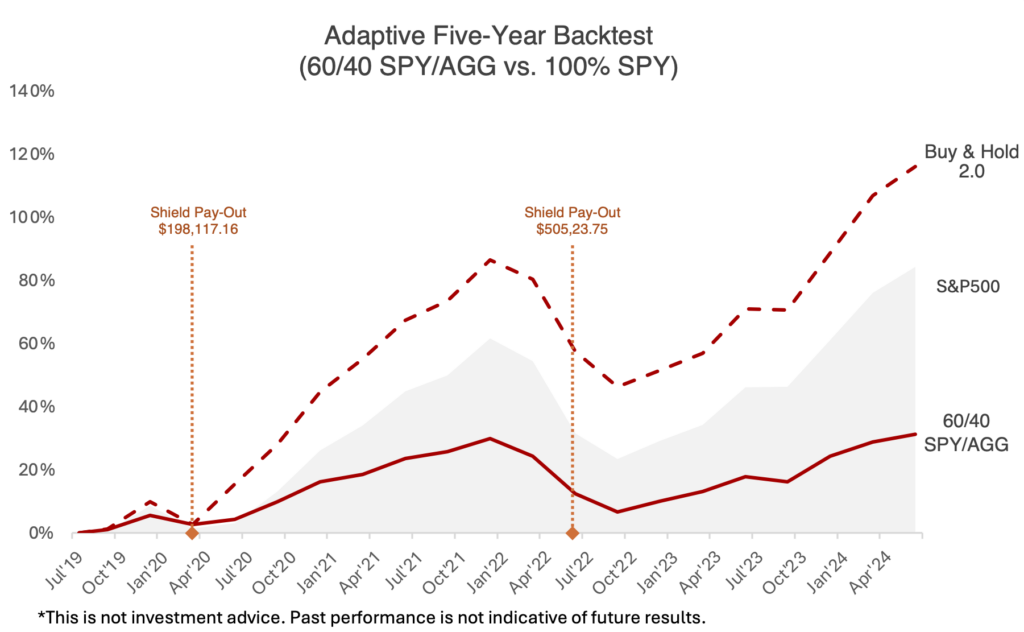

Adaptive’s powerful Backtest tool enables advisors to show clients how hedging would have performed in the past for a particular portfolio. In this example, a ‘plain vanilla’ 60/40 portfolio is compared to a stock portfolio which is hedged with index puts over the five years from mid-2019 to mid-2024. The remarkable results ? The hedged portfolio (‘Buy & Hold 2.0’ dotted red line) outperformed not only the risk-equivalent 60/40 portfolio (‘60/40’ solid red line)—it even outperformed the much riskier all-stock portfolio (‘S&P 500’ grey area):

A few key points about the Backtest & this chart:

Buy & Hold 2.0: Pay-outs Can More Than Cover the Cost of Protection. One would expect the cost of hedging to be a drag on performance; it is a drag, in general. Nevertheless the two pay-outs in this particular Backtest scenario happily more than cover the cost of five years of hedging with index puts. You can see these pay-outs in the two dotted orange vertical lines. The value of the pay-outs are further compounded by reinvestment in the hedged portfolio.

Rebalance 2.0: Pay-outs Help Rebalance & Buy Lower. Much like classic portfolio rebalancing, Buy & Hold 2.0 assumes that pay-outs are reinvested in the portfolio, helping make use of stock market corrections to buy at lower prices. The Adaptive Backtest includes a table of the compounded cost and benefit of all hedges to help compare the hedged portfolio to its 60/40 risk-equivalent & the unhedged portfolio. To further help with direct comparisons, the 60/40 risk-equivalent portfolio is rebalanced quarterly for a consistent asset allocation, effectively selling high & buying low as stocks & bonds follow their own paths.

Risk-Equivalent Downside Protection. The level of put protection can be calibrated to ‘buy down’ the risk of a portfolio to the downside risk-equivalent of a less risky portfolio. In this Backtest scenario we have created a 60/40 risk-equivalent. It could easily be a downside risk-equivalent to an 80/20 portfolio (more aggressive, less hedging) or even a 20/80 portfolio (less aggressive, more hedging). Adaptive streamlines this process by calculating the risk-equivalent protection level & protection periods. We’ll have more about this in another post.

- Portfolio Hedging with Index Matching. This Backtest assumes a plain vanilla portfolio but show any stock portfolios to the Adaptive software (no owner names needed), & it will look for a suitable, tax-smart index fit (S&P 500, Nasdaq 100, Russell 2000) to consider as an efficient hedge instead of (1) put buying on individual positions or (2) selling & thus missing out on the possibility of equity growth. Even concentrated tech portfolios such as the Magnificent Seven can often benefit from index hedging. See for yourself with your own portfolios and a free 30-day trial.

- Free On-Demand Webinars. Learn more from free on-demand webinars with financial advisor & options expert Mike Tosaw . You can also watch my free webinar with Nasdaq from earlier this year focused on using Nasdaq 100 index puts.

Philip Sun, a former portfolio manager, is co-founder and CEO of Adaptive Investment Solutions. He also teaches finance and data analytics at Boston University and Hult International Business School. An amateur violinist, Philip is a devotee of Bach and gypsy jazz. In the early mornings, you can find Philip training for sprint triathlons in the western suburbs of Boston. Contact Philip via LinkedIn and follow Adaptive on Twitter.